prince william county real estate tax due dates

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Payment by e-check is a free service.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Provided by Prince William County Communications Office.

. TAX DUE DATES. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Recurring Reports to the Congress A Directory.

The 2022 first half real estate taxes were due July 15 2022. Personal Property Taxes and Vehicle License Fees Due. December 5 annually Business Gross Receipts BPOL.

Prince William County collects on average 09 of a propertys. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. State Income Tax Filing Deadline.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. December 5 annually Business Gross Receipts BPOL. Property taxes in Prince William County are due on June 5th.

There are several convenient ways property owners may make payments. When prompted enter Jurisdiction Code 1036 for Prince William County. April 30 annually Town Decals.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Learn all about Prince William County real estate tax.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. If you have not received a tax bill for your property and believe you should have contact. The median property tax in prince william county virginia is 3402 per year for a home worth the median.

Press 1 for Personal Property Tax. Prince William County collects on average 09 of a propertys. A convenience fee is added to payments by credit or debit card.

During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the. July 2 2022. ITEMS SUBJECT TO THE PERSONAL PROPERTY TAX.

FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or. Board Extends Due Date for Real Estate Taxes. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Second-half Real Estate Taxes Due. Personal Property and Business Tangible Tax were due Oct 6th Business. You do still have to pay to Prince William County.

In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles. All you need is your tax account number and your checkbook or credit card. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient. The real estate tax rate for the 2019 tax year is 120 per 100. Press 2 for Real Estate Tax.

The due date for 2nd half 2021 real estate taxes is december 6 2021. Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Enter the Tax Account numbers listed on the billing. Business License Renewals Due.

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Think Twice Before Pre Paying Your Prince William Property Taxes

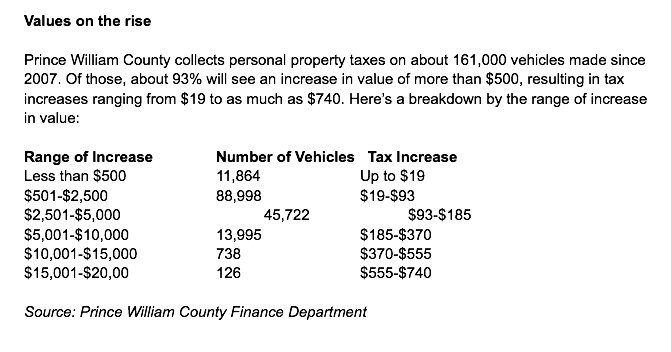

Sticker Shock Unprecedented Rise In Vehicle Values Means Higher Tax Bills Headlines Insidenova Com

Prince William County Government Virginia Woodbridge Va

Prince William Times 08 25 2022 By Fauquier Times 52 Issues Prince William Times 52 Issues Issuu

Prince William Just Inherited A 685 Year Old Estate Worth 1 Billion

Prince William County Weighs Proposals That Could Accelerate Data Center Growth

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

Prince William County Pwcgov Twitter

Prince William County Property Management Prince William County Property Managers Prince William County Va Property Management Companies

Prince William County Government

Prince William Considers Tax Hike On Data Center Equipment

Pwcs Calendar Form Template In Ms Word Doc Pdffiller

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Disabled Veterans Don T Have To Pay Property Tax In Prince William County Youtube

13505 Telegraph Rd Woodbridge Va 22192 The Landing At Prince William Town Center Loopnet